What do large pricing suggest into the housing marketplace?

Insider’s pros choose the best services to make advised choices with your money (here is how). Sometimes, i discover a payment from our people, although not, the viewpoints are our own. Terms and conditions apply to now offers noted on this page.

An average 31-12 months fixed mortgage speed rose so you’re able to six.92% this week, predicated on Freddie Mac computer. Here is the highest rates while the 2002. Average 15-12 months repaired rates including surpassed https://paydayloancolorado.net/avon/ 6% for the first time during the fourteen ages.

With the Thursday, the brand new Bureau from Work Analytics put out their Individual Speed Directory report to possess September. Rates flower 8.2% year-over-year last day, an incredibly slight slowdown from August’s 8.3% speed, but nonetheless more than asked.

That it nevertheless-sexy CPI declaration, combined with past week’s solid operate report, almost claims that the Federal Reserve commonly follow several other additional walk on given loans speed in the the November appointment.

Rising inflation and you may Provided hikes has actually helped force mortgage rates upwards more than about three percentage facts this present year. Towards the latest economic study directing to further Given price hikes, financial rates are required to keep elevated for the remainder of this year and certainly will just start to .

Luckily for us one avenues have previously cost when you look at the traditional for additional grows, thus while you are mortgage pricing are not likely to fall, they could perhaps not rise far after that.

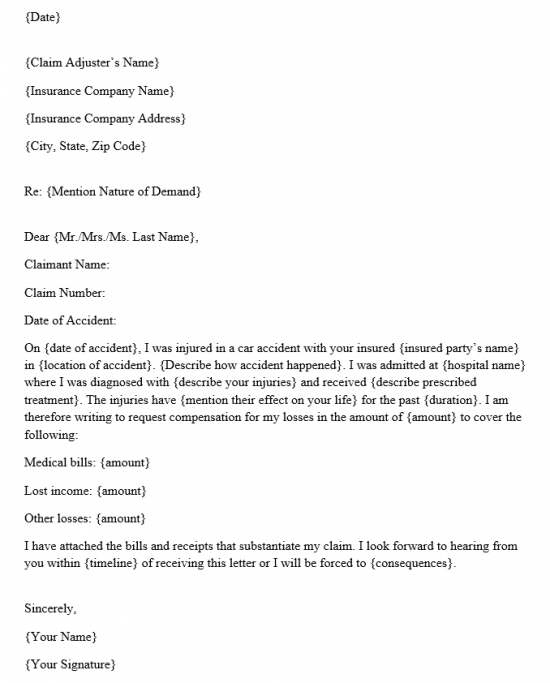

home loan calculator

- shell out one to 25% a high advance payment create help save you $8, on focus charges

- Reduce steadily the interest rate by step 1% would help you save $51,

- Shell out an additional payment $500 each month carry out reduce the label of your own mortgage because of the 146 week

Because of the hitting Additional information, additionally see the count might spend across the lifetime of your own financial, for instance the amount of dominating versus attention.

Try home loan costs expanding?

Home loan pricing started to get over historical downs in the 2nd half of 2021 as well as have risen somewhat at this point for the 2022.

For the past 1 year, the user speed list has increased because of the 8.2%. The new Federal Set aside could have been struggling to continue rising prices in check that is expected to increase the target federal loans price a couple of more times this year, pursuing the grows in the the previous four group meetings.

However in person associated with brand new provided finance rate, home loan costs are often forced higher due to Provided speed hikes and investors’ hopes of the fresh feeling ones nature hikes into discount. .

Inflation stays higher, but has started in order to slow, which is a great indication having mortgage rates as well as the cost savings typically.

Whenever home loan cost go up, this new to invest in energy away from homeowners decrease, as more of their estimated houses finances should be allocated to notice costs. In the event the cost score sufficient, people should be shut out of one’s field entirely, air conditioning demand and you may getting down stress on the household price growth.

Home prices provides went on to go up this season, however, within a much slower speed than what there are more during the last a couple of years.

What’s a great home loan rate?

It could be difficult to determine if a lender is offering you an excellent rates, that is the reason it’s very vital that you score pre-accepted regarding numerous lenders and you will compare for each and every offer. Get pre-acceptance from at least several lenders.

Your price is not necessarily the merely point that matters. Definitely compare each other your own monthly will set you back along with your initial costs, and financial fees.

Even in the event home loan costs is greatly influenced by monetary activities outside of the manage, there are activities to do to be certain you earn a beneficial an excellent rate:

- Consider repaired costs in the place of variable prices. You are capable of getting a diminished introductory rates which have a varying speed financial, and is useful if you are planning to maneuver till the stop of basic months. But a fixed speed would-be better if you might be purchasing a good family permanently, since you try not to chance your price rising later on. Have a look at the newest cost supplied by the bank and you can weigh the choices.

- Look at the cash. Brand new more powerful your debts, the reduced your own mortgage rate are going to be. Come across a way to improve your credit history otherwise decrease your debt ratio, if required. Saving to have a bigger down-payment can also help.

- Choose the best lender. Per lender charge additional mortgage rates. Selecting the most appropriate that to suit your financial predicament will allow you to get a better rates.