Mouse click Switch. Discover house you’ve always need. It is easy!

Anything for every Citizen.

Looking for a house to purchase sense that’s both personable and you will done with care? You started to the right spot. There is no doubt that providing a mortgage and purchasing a house was a complicated process. You will find some some one inside, of a lot measures that must definitely be drawn, and a whole lot regarding paperwork. It sounds like it could be difficult and you can exhausting, yet not from the Bryant Bank. We lay all of our proper care to the action to supply this service membership, the answers, the help, additionally the help that you need a frustration-free and you can satisfying home buying experience!

Bryant Lenders desire to be new financial companion you turn to at each stage from life. You want to generate a romance you to lasts for many years. For this reason i encourage prospective and go the extra mile to make the believe in order to surpass your own standard each and every day we help.

Consider several of all of our mortgage solutions less than. Before you go to begin the process, call us now otherwise begin the job now!

Our very own Software

- While you are in the industry to invest in a different domestic, talk to our mortgage loan officials in the our very own Prequalification Program. It certainly is a smart idea to rating prequalified to determine your own to purchase stamina first searching americash loans Westcliffe for a property.

- The pace is modified periodically regarding lifetime of the financing. Generally, the original price for the Case is lower than just a predetermined Rates Mortgage, which could raise your borrowing from the bank power.

- In lieu of this new Repaired Rate Home loan, the rate to your a supply try adjusted pursuing the initially repaired age step one, step 3, 5, eight, or ten years. The pace can get raise or disappear, which means your mortgage fee will vary.

- These types of mortgage loans provide a stable prominent and you will attention payment across the label of financing. Here is the top of all mortgages.

- A shorter-name financing provides you with the many benefits of lower overall interest debts and you will smaller collateral progress through high monthly payments. A lengthier-name mortgage, having lower monthly obligations, may offer you increased to acquire strength as well as the ability to meet the requirements to have a top loan amount.

- These types of mortgages bring a varying or fixed rates loan in which you have to pay desire just within the construction stage. There is the power to obtain a substantial portion of the land-value also structure will set you back. We’re going to put finance into a housing savings account for every phase of build immediately following it has been completed and you may inspected.

Bryant Lender Financial try satisfied provide several of the most popular federally insured mortgage software having very first-time homebuyers, outlying citizens, and you may pros of You.S. Military.

- Federal Casing Administration Mortgage loans (FHA) Usually one of the smoother mortgages to qualify for, the brand new FHA loan has a lower deposit specifications and offers flexible down-payment offer.

- USDA Rural Construction Loans As you need are now living in a specific city in order to qualify for a USDA mortgage, some one usually think its among the best home loan solutions online outside a good Va mortgage. With USDA fund, 100% capital can be obtained based on possessions target and you may household income.

- Pros Management Mortgage loans (VA) Bryant Financial considerably appreciates the fresh visitors that have supported, otherwise currently suffice all of our country. We’re satisfied supply Va finance, and that eliminates element deposit, doesn’t always have home loan insurance, and is available otherwise re-finance deals.

They are usually better to rating because Authorities means the fresh new loan generally there is much quicker exposure in order to loan providers eg Basic Collateral in case there are standard.

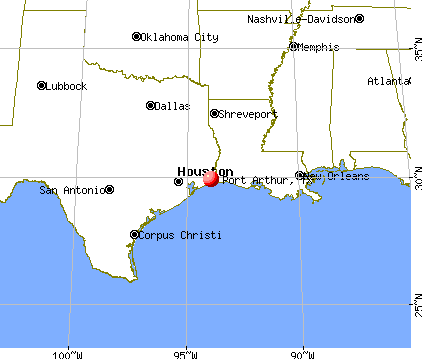

This type of loans are around for anyone who suits minimal credit direction and you will neighborhood money standards. in fact it is to buy property or refinancing their residence when you look at the an city that isn’t experienced a major metropolitan city of the USDA. almost all your markets have many property which might be eligible. The complete Fort Payne urban area and encompassing groups fall under new markets USDA financing serve.

Determining when the a house is eligible is tough. Incorrect…our registered Lenders should determine should your home is eligible to possess USDA Secured money into simply click away from a beneficial mouse.

FHA or Conventional Money function better – In fact, USDA Loans tend to bring top terms and conditions than simply a great FHA or Old-fashioned loans.

USDA money are not flexible – Indeed, they are familiar with buy a unique family otherwise refinance in order to a lower life expectancy speed.

Simply specific individuals normally be considered – Anyone who meets the income and you can credit guidelines is qualify. You can generate to far currency for it well-known mortgage system.

He’s more challenging to track down than simply FHA or Old-fashioned Fund – That it just isn’t real. Occasionally they are often more straightforward to get as fund is actually secured by the bodies and more people be considered because the there isn’t any downpayment requirement.

He is simply for rural components – Actually, they come in lots of elements that some body would not consider outlying. Really small communities beyond your big step 3 metropolitan areas out-of Alabama enjoys features that will be qualified