More twelve,100000 Connecticut PPP financing were flagged to possess inquiries

In new research of Salary Cover System credit, boffins estimate one between 10% and you will fifteen percent off finance acknowledged within the Connecticut went to consumers having been double dipping if not delivering excess amount throughout the save system – in many cases inadvertently, however, other people with deceptive tries.

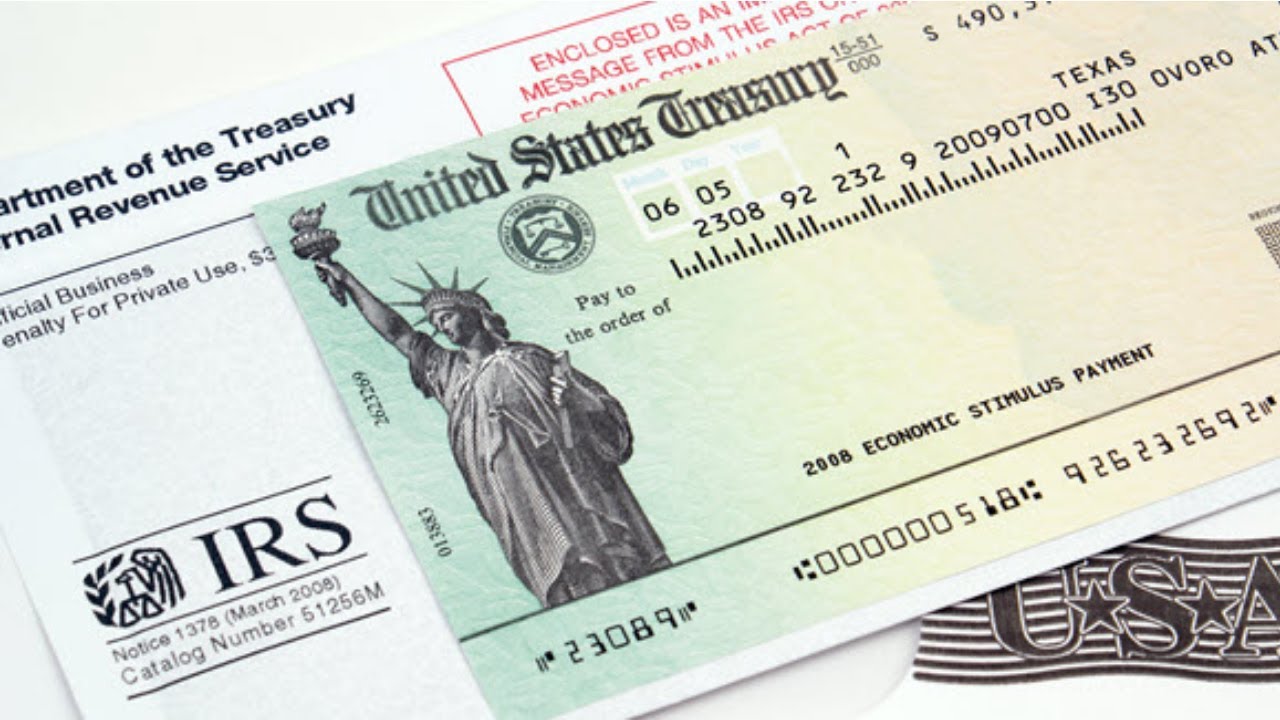

Congress integrated PPP as one of several save packages from the Coronavirus Assistance, Rescue and you can Financial Protection Work as a way to remain people out of unemployment benefits, having loans to get forgiven having firms that failed to lay away from team when you look at the COVID-19 pandemic.

New part of condition loans got its start having Connecticut recipients was basically below almost every other states, experts at the School of Texas within Austin determined. In the united states, the research flags step 1.2 mil finance with significant matter scratches predicated on numerous criteria, with millions much more open to concerns according to any one function it examined.

UT boffins put the latest fault mostly toward rat-a-tattoo acceptance regarding money of the FinTech loan providers having proliferated for the past years, offering online fund networks as an alternative to important finance companies and you may borrowing unions.

Across the three installments of program into the Connecticut, over 119,three hundred loans had recognized for $nine.9 mil into the PPP resource, providing support more than so many efforts. Yet, just more than forty eight,100000 fund was forgiven inside Connecticut, adding up to help you $5.1 billion inside the service getting payroll, lease, utilities or other charges for firms that failed to lay off pros.

You.S. Sen. Richard Blumenthal informed Hearst Connecticut to the Wednesday he’s got analyzed the fresh UT research and you may don’t quibble to your conclusions, including the government have good-sized resources to recoup loans using the fresh False Says Act and other laws.

We asked for openness at the beginning for the system – brand new Trump government are extremely loath to provide they, Blumenthal said Wednesday. In some way, if there is people swindle otherwise abuse of finance around this system it should be pursued therefore the money retrieved. . Tragically, there is nothing book regarding it variety of scam.

Lenders was permitted to charges charges so you’re able to procedure PPP funds, toward U.S. Treasury bearing the possibility of one defaults. Finance companies got absolutely nothing notice to put together assistance to help you processes finance, taking on complaints a while later to possess other sites crashing and other affairs in the granting financing and soon after records.

Since , fintech lenders accounted for 70 % out of loans started through the Salary Security Program, and that consumers might get forgiven once they remaining specialists on their payrolls with the regards to their fund. Just after JPMorgan Pursue and Lender out-of America, the second about three greatest machines away from PPP charges had been the latest fintech lenders Mix River, Funding Including, and you will Harvest.

Due to the concentrate on the fast shipments of money, the new PPP failed to are sturdy confirmation conditions, UT experts John Griffin, Sam Kruger and you may Prateek Mahajan county inside their declaration. Brand new sheer range of your 10s and thousands of doubtful funds got its start by many people [fintech] lenders suggests that of several loan providers either recommended eg finance, became good blind attention in it, otherwise got lax oversight methods.

During the March, work out-of Inspector General provided a breakdown of the problem out-of copy PPP funds, choosing one to $692 mil was approved in order to 4,260 borrowers who seemed to double drop about program situated for the an analysis of taxation personality check this site quantity or other guidance

Rectangular, Intuit, and Financing That is singled-out for comparatively low cases of PPP funds flagged by the study, into the article writers hypothesizing the individuals enterprises features consumer bases ruled from the legitimate firms that rely on them having a package regarding economic services with associated auditing.

The latest UT experts centered its analysis into several procedures also funds so you’re able to businesses that weren’t joined; multiple enterprises listed on solitary domestic address contact information; abnormally large settlement each staff; and enormous inconsistencies during the operate stated having various other government system.

The research hypothesizes you to authorities possess yet , so you’re able to detect the new vast greater part of situation PPP fund provided through on the web loan providers.

- fifteen CT places the spot where the housing market try burning

- Dan Haar: Quinnipiac School finds a home for the finalized Ireland’s Great Appetite Art gallery

- Zero. seven UConn ladies baseball against. Georgetown: Date, Television and you may what you need to see

- No. 1 Bristol Main passes No. 2 Northwest Catholic getting second straight CCC males baseball term

- 2022 CIAC Men Hockey Competition Scoreboard

- Jeff Jacobs: Immediately following a beneficial coach’s spouse has been detained, where and when does it prevent?

- William Shatner regarding Celebrity Trek’ magnificence noticed within CT deli

Not every one of people was on account of scam, however, with the result of consumers putting in content software with the the belief they made problems within their very first apps, or that they was indeed in some way maybe not registered for the program.

A federal Pandemic Reaction Liability Committee has been probing disbursements, around Robert Westbrooks who spent 5 years because the inspector standard managing the fresh Your retirement Work for Guaranty Corp.

In which proof swindle is positioned, the brand new Agencies out of Justice could have been indicting consumers. DOJ recharged nearly a hundred anybody this past year who needed $260 mil thru programs DOJ alleges were fake, all over both private enterprises and you will prepared crime bands.

During the early Get, government prosecutors when you look at the Ohio included a couple of Connecticut citizens in an enthusiastic indictment of these a ring-in hence SBA provided $step three.step 3 million lower than PPP in addition to faster Monetary Injury Disaster Mortgage program. Specialized pleas keeps but really are inserted on the internet in the event.

Our home Subcommittee towards the Coronavirus Crisis possess launched probes to the fund prolonged by the multiple on the web lenders

3 days later on, a residential property creator and you will Stamford resident Moustapha Diakhate, forty five, is faced with financial and you will cord con immediately following finding $dos.9 mil in PPP finance issued from the Citibank for five people they have registered within his term: Ansonia Builders LLC, Winsbay Inc., People Connection Classification LLC, Washington Management LLC and Diakhate Investment Inc. Towards the Saturday, DOJ and Diakhate’s attorneys filed a shared obtain longer to own substantive conversations in order to see input out-of Citi.

An effective DOJ spokesperson for the The brand new Haven told Hearst Connecticut for the Wednesday that other assessment is significantly less than means, instead of specifying how many and their interest.